|

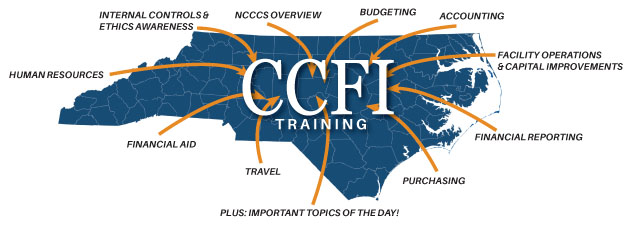

CCFI is the Community College Financial Institute. CCFI will offer courses on a variety of subjects including a 5-day basic course as well as courses on more advanced topics. All courses are conducted as an interactive class where students will learn from the experience of other students on business operations. Class size is limited to 25 to 30. Courses now being offered are listed below: Please note that we have a new CCFI Coordinator, Cindi Goodwin. Send questions to Cindi Goodwin at [email protected] CCFI Courses - Register Below Payment is required when you register (Payment by Credit Card is Preferred)

Check payments should be sent to: ACCBOc/o Shelly Alman2033 Shadwell CtGastonia, NC 28056

(Cost varies, lunches included when in person - Please read information shown below under course descriptions): Refund Policy: No refunds for cancellation 14 days prior to the start of the course. If a student is unable to make the registered course, it is encouraged to seek a replacement from the same college to attend the course. Partial credit will be allowed for health issues; the credit can be used for future courses. Course Descriptions Courses will be taught using a cooperative and collaborative learning experience focusing on interactive lectures and group discussions. The course will be taught by experienced Community College professionals. The only prerequisite for this course is that you are employed by a North Carolina Community College or by the North Carolina Community College System Office. No advance preparation is needed for this course. Course material will be emailed to you before the first day of the class. Cost of Courses The cost of the courses varies upon the length of the course and the CPE credit earned, The cost of each course is based upon $15.00 per CPE credit hour earned. The cost of each course includes the cost of lunches. Refund Policy: No refunds for cancellation 14 days prior to the start of the course. If a student is unable to make the registered course, it is encouraged to seek a replacement from the same college to attend the course. Partial credit will be allowed for health issues; the credit can be used for future courses. Class hours are normally 9:00am to 5:00pm each day. This will allow those in proximity to the college to return home each day; for all others, a list of recommended local hotels is available.

What should a student bring to the course? A laptop or tablet (iPad) capable of accessing the internet will be required. Cell phones are permitted but must be kept on vibrate during class instruction. What information is needed for a student's registration? We are requesting the student's name, college, position in the college, length of time at the college, and their cell /telephone number. What can I wear to class? The attire for the class will be causal. It is a very busy day and want you to be comfortable. NEW !!! PURCHASING COURSE This course is designed for new Purchasing Agents, or existing Purchasing Department employees. Participants will gain a better understanding of applicable NC General Statues, NC Administrative codes, and purchasing guidelines including Inventory and Reporting. Length of Course? Three days CPE credit: This course offers 21 hours of CPE credit - awarded upon completion of the course.

Basic Introductory Course Who should attend training? This course is intended as an orientation course for new employees, a refresher for more seasoned employees, and will encompass many of the critical business office functions. All employees throughout the college are eligible and encouraged to attend. Length of course? Five days CPE credit: This course is designed for Certified Public Accountants and 35 hours of CPE credit will be awarded upon completion of the course. This course is a basic accounting course covering Community College's management, budgeting, and accounting procedures and policies. It has been designed to create a stronger Community College System and prepare you for the next step in your Community College career. The course will cover the following topics:

This course is a 3-day course designed for new Controllers and Accountants that have responsibilities on managing the college's everyday financial activities. Some of the topics covered in this course include:

Who should attend training? Controllers, Accountants, and any other employees having significant responsibilities for any of the topics listed above. Length of course? Three days CPE credit: This course is designed for Certified Public Accountants and 21 hours of CPE credit will be awarded upon completion of the course.

Financial Statement and CAFR Preparation Course This course is a 3-day course on preparing the Financial Statements and CAFR. The course covers financial statement pre-planning activities, accrual journal entries, cash flow template, completion of the statements including notes and MD&A, the CAFR, audit findings, common errors, and how to review the statements. Who should attend training? This course is for employees that are primarily responsible for completing the college's year-end financial statements and CAFR package. Length of course? Three days CPE credit: This course is designed for Certified Public Accountants and 21 hours of CPE credit will be awarded upon completion of the course.

Budgeting Course This course is a 3-day course focused on North Carolina Community College budgeting process and procedures. This course will take an in-depth look at community college budget regulations, policies, procedures, and processes. Who should attend training? This course is for employees that are responsible or have a role in the preparation and monitoring of college, state, local, and institutional funds budgets. Length of course? Three days CPE credit: This course is designed for Certified Public Accountants and 21 hours of CPE credit will be awarded upon completion of the course.

Capital Projects and Interscope Course This course is a 3-day course focused on North Carolina Community College capital projects process and procedures. This course includes Interscope training. Who should attend training? This course is for employees that are responsible or have a role in the overseeing or monitoring capital projects or monitoring capital projects or capital project budgets. Length of Course? Three days CPE credit: This course is designed for Certified Public Accountants and 21 hours of CPE credit will be awarded upon completion of the course.

Financial Aid for Business Officials This course is a 2-1/2-day course focused on North Carolina Community College Account Receivables and Business Officials responsibilities pertaining to Financial Aid transactions. Who should attend training? This course is for employees that are responsible or have a role in the monitoring of financial aid transactions on the general ledger and ARCR subsidiary ledger. Length of course? Two and one-half days CPE credit: This course is designed for Certified Public Accountants and 18 hours of CPE credit will be awarded upon completion of the course.

Human Resources Policies and Procedures This course is a 2.5-day course focused on North Carolina Community College HR policies. The course includes a discussion on State Board requirements, what should be included in each policy, and writing policies. Who should attend training? This course is for employees that are responsible or have a role in the writing and enforcement of college's HR policies. Length of course? Three days CPE credit: This course is designed for Certified Public Accountants and 21 hours of CPE credit will be awarded upon completion of the course. Human Resource Course This course is designed to provide participants with an overview of current HR and employee/employment related issues, policies, and procedures applicable to institutions of higher education. The course includes a discussion on State Board Code (SBC) requirements and how being both a governmental and educational employer impact legal requirements that influence policies and other college practices related to employment management. During this 2.5-day in-person course, participants will be encouraged to discuss and share best practices from their community college. Topics covered will include: Legal compliance (SBC, FMLA, ADA, FLSA, leave benefits, TSERS. SHP)

Who should attend training? This course is designed for both entry-level to advanced HR and Business Professionals working in the community colleges. Length of course? Two and a half days (no lunch provided on the last/half day) CPE credit: This course is designed 18 hours of CPE credit will be awarded upon completion of the course. Community colleges may request to be a host college. There are a few requirements that are required to be met prior to hosting. Please contact [email protected] if you are interested!

|